Hello everyone,

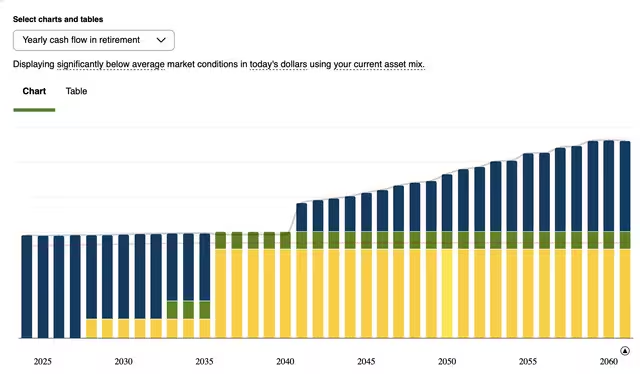

This chart represents the projected yearly cash flow from Fidelity's Retirement Planning tool under significantly below average market conditions. Starting at age 75, you can see additional withdrawals from savings (blue bars) increasing over time due to Required Minimum Distributions (RMDs).

![Image]()

![Image]()

However, I expect our expenses to remain constant in today's dollars throughout retirement, meaning we likely won’t need this extra income.

From a tax perspective, wouldn't it be more efficient to smooth out withdrawals over the entire retirement horizon? This could mean increasing withdrawals earlier to avoid sharp RMD spikes later. Essentially, is it "okay" to spend more now to achieve better tax outcomes over the long term?

Would love to hear your thoughts or strategies for managing this situation!

This chart represents the projected yearly cash flow from Fidelity's Retirement Planning tool under significantly below average market conditions. Starting at age 75, you can see additional withdrawals from savings (blue bars) increasing over time due to Required Minimum Distributions (RMDs).

However, I expect our expenses to remain constant in today's dollars throughout retirement, meaning we likely won’t need this extra income.

From a tax perspective, wouldn't it be more efficient to smooth out withdrawals over the entire retirement horizon? This could mean increasing withdrawals earlier to avoid sharp RMD spikes later. Essentially, is it "okay" to spend more now to achieve better tax outcomes over the long term?

Would love to hear your thoughts or strategies for managing this situation!

Statistics: Posted by cfo — Mon Dec 16, 2024 5:36 am — Replies 9 — Views 497