Looking for a review of the current and proposed Portfolio.

Note, I am looking for two sets of feedback: "As-is" in terms of AA proposal (see image), what improvements or changes do you recommend to the proposal. That is most important. Secondly, discuss the AA I am proposing to inform me and determine if it makes sense. Of course the feedback is interdependent.![Wink :wink:]()

Here are some highlights of goals/why, I am proposing this:

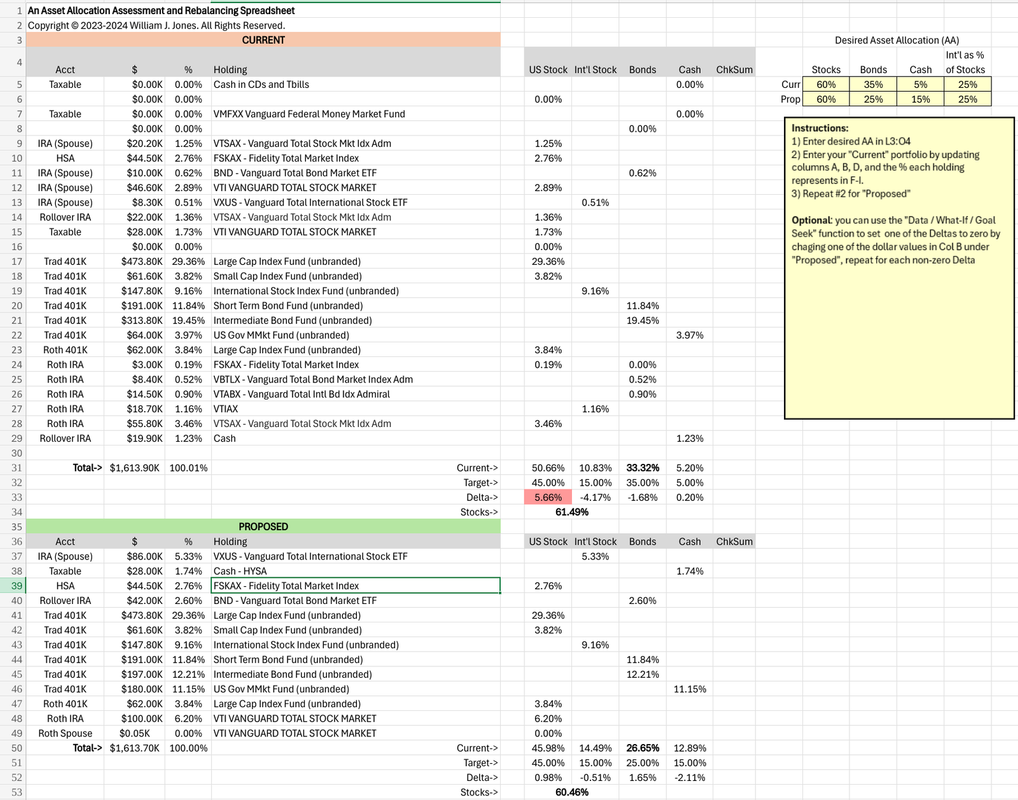

Here is a screenshot from the AA spreadsheet of the proposal:

![Image]()

Note, I am looking for two sets of feedback: "As-is" in terms of AA proposal (see image), what improvements or changes do you recommend to the proposal. That is most important. Secondly, discuss the AA I am proposing to inform me and determine if it makes sense. Of course the feedback is interdependent.

Here are some highlights of goals/why, I am proposing this:

- Whole portfolio view/optimization - did not do this before and looking to fix

- Simplify the overall portfolio (# of assets, accounts, etc) - incremental improvement is fine

- Moving assets from Vanguard to Fidelity to simplify again (therefore, moving from VG MF to ETF for Vanguard trading in Fidelity)

- Proposing to change AA from 60/40 to 60/25/15 - because my hope/assumption is retiring early in the next 1-3 years. (Advice on this proposed AA separately from the proposal is welcome too) - I am proposing this based on the 'bucket strategy', lack of taxable % for early spending, capture some gains in 2024 to cash, and trying to be 'ready' for retirement.

- Improved asset location - bonds in IRA, stocks in Roth

- After seeing @bonesly posts and learning from them, trying to improve my overall positions.

- Large cap is a S&P 500 index.

- Interm bond is Bloomberg capital US Aggregate bond index

- Short term bond is Bloomberg 1-3 year Government Bond Index

Here is a screenshot from the AA spreadsheet of the proposal:

Statistics: Posted by retire57nh — Sun Jan 12, 2025 12:52 pm — Replies 3 — Views 161