Perhaps the thread ought to have been titled, instead:

Should you hedge your TIPS ladder with an SPIA?

Arguably, the TIPS ladder is the more foundational product, and the life annuity is the more derived and secondary.

-TIPS are guaranteed by the full faith and credit of the US Treasury. Full stop. An SPIA is guaranteed by some financial intermediary whose financial statements, even though available for inspection, are probably beyond the capability of most annuitants to evaluate.

-A TIPS ladder guarantees a level stream of real income over a preset interval. An SPIA guarantees only a stream of fiat currency, and only for some unknown interval which could be quite short (=life).

Be that as it may, the two products do seem to have offsetting strengths and weaknesses, making it possible that some hedged combination of the two might be superior to either alone.

-The SPIA insures against excess life

-The TIPS ladder insures against excess inflation.

This thread examines various possible combinations.

“Hedge once and done” versus “Hedge as you go”

Hedge once and done means to take out the SPIA and set up the TIPS ladder at the same time in mutually calibrated amounts. It is the primary hedge examined in this thread.

Hedge as you go entails annuitizing a larger sum than needed for spending, and investing the excess income in TIPS each year, until inflation catches up and there is no longer an excess, after which point, the TIPS accumulation begins to be drawn down to sustain real spending power. It will be set out in a later post.

Any hedge has to be compared to BOTH of the two pure, unhedged alternatives:

1.All the funds placed in an unhedged SPIA

2.All the funds put into a TIPS ladder, no SPIA

The purpose of the thread is to explore such comparisons.

Let me acknowledge once, at the outset, that there are many, many ways to skin the annuity cat (see, for instance, StillGoing’s thread on deferred annuities viewtopic.php?t=433101). This thread confines itself to one approach.

Illustrative case

For the initial evaluation, a single illustrative case is held constant.

•Clients are a married couple in their early 70s (say, 74) with a joint life expectancy of 20 years.

•The crediting rate on the SPIA is about 5%, with a 10-year term certain guarantee

•Inflation is assumed to be 3%

•The real rate on TIPS is the difference, at 2%

•Given the assumed crediting rate and life expectancy, an SPIA in the amount of $125,000 will produce a fixed income stream of about $10,000 per year, guaranteed for the first ten years.

The next decision is how far out to hedge, i.e., to what age. Mortality tables, by current convention, have non-zero entries out to age 119. Going out to that age would imply a very expensive hedge that would almost certainly be in excess of what is needed.

Conversely, about half of any pool of 74-year-old couples will outlive their life expectancy of age 94, implying the need at least to hedge past that age.

For these illustrations I hedge out to age 100. About 11% of the pool will survive to 101 or older; these fortunate individuals will see the hedge come off and real income fall. However, the nominal payment will continue for life, which is part of the appeal of a hedged combination.

Couples of this age, convinced that one will prove to be a centenarian, can hedge past age 100, out to age 104, using the longest TIPS available in the US. There is only a 2.6% chance that that hedge will fall short (=survival to 105 and beyond). Preliminary tests showed no difference in the pattern of results for hedging 30 years instead of hedging to age 100, so no further discussion will be made.

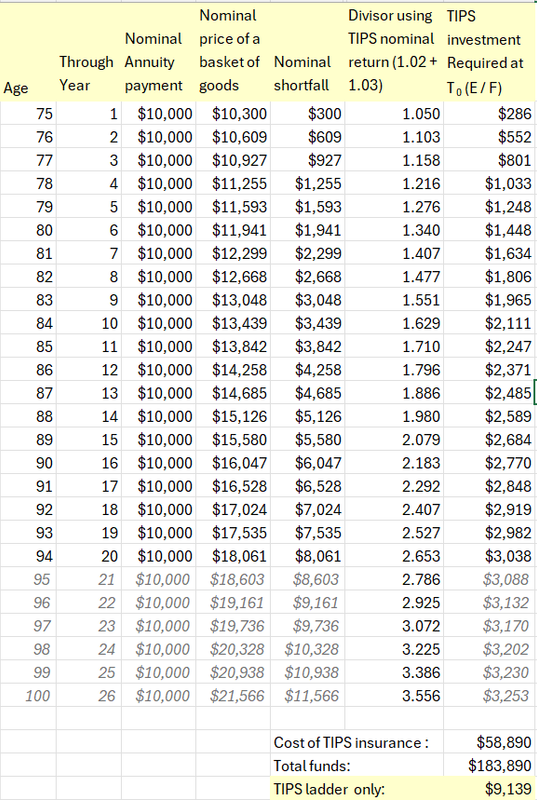

Here’s how the setup looks in table form.

Table 1

![Image]()

*If inflation were constant and every TIPS maturity yielded exactly 2.0% then the divisor should be 1.02 * 1.03 = 1.0506. Uncertainty on this score suggests using the sum instead.

The cost of the hedge is about $59,000, or 47% more than the $125,000 annuitized. Total amount available to put into either of the two pure alternatives is thus $183,890.

Tests of the hedge

The pure TIPS ladder alternative can be tested by means of the PMT function, entering the real return of 2%, the period of 26 years, and the total funds available. As shown at the bottom of the table, the pure ladder could only sustain real payments of $9,139 per year, decisively less than the $10,000 real sustained by the hedged combination.

I should note that $9,139 is not bad within a sustainable withdrawal rate frame; it corresponds to a withdrawal rate of almost 5% (albeit, not strictly comparable to the 4% rule, which assumed a 30-year span).

Score 1 for the hedge.

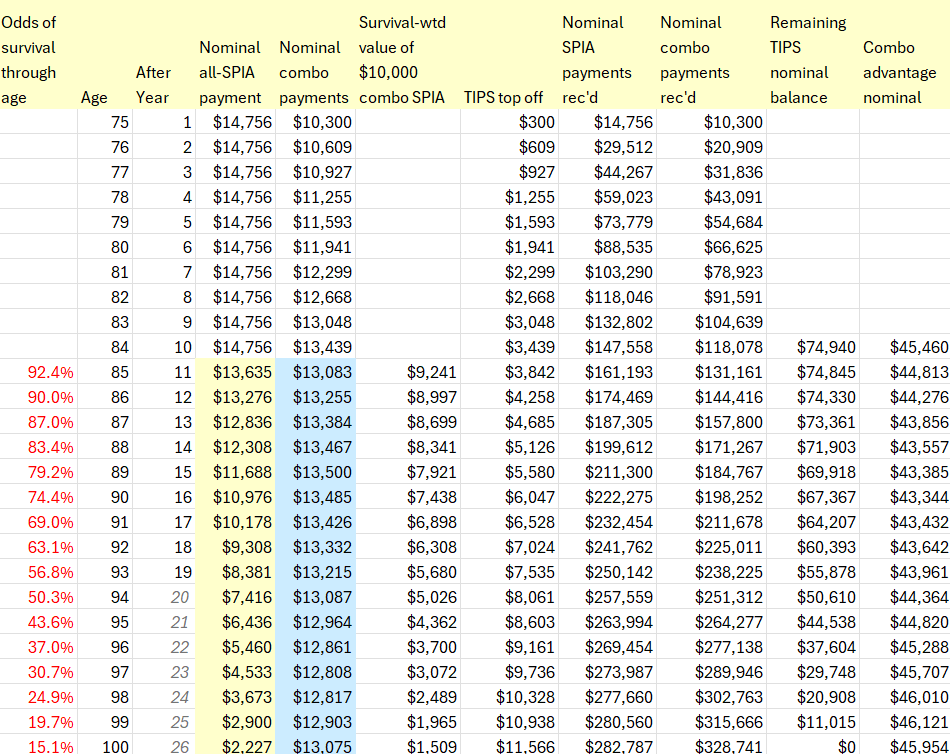

The pure SPIA alternative is a little more difficult to test. A second table will be of assistance.

Table 2

![Image]()

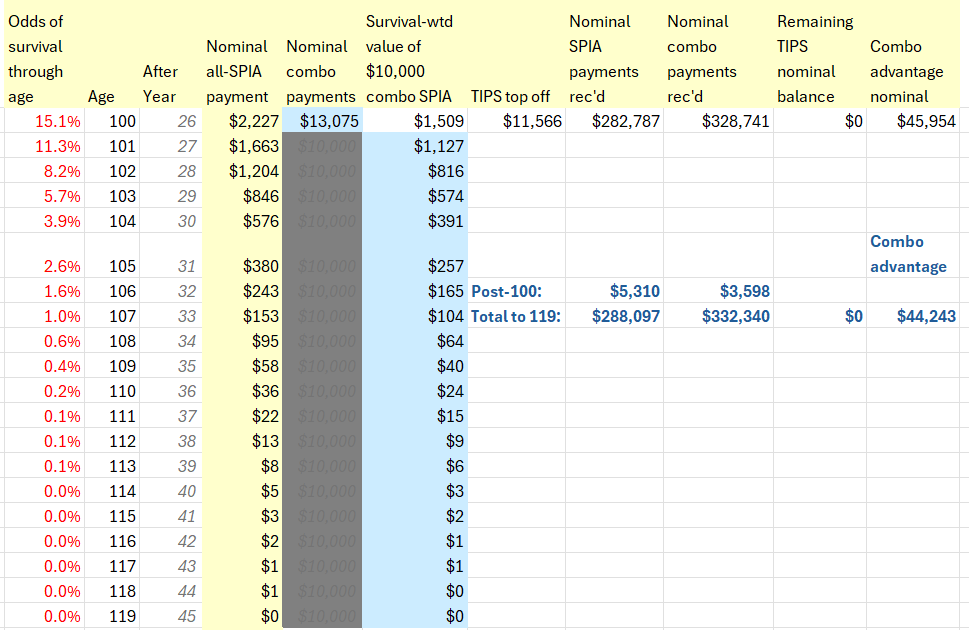

table continues:

![Image]()

If we annuitize all the available funds, the annual payment increases, no surprise, by about 47%, to $14,756. That is considerably more, in year 1, than the $10,300 paid under the combo.

Look next at the results after ten years. The SPIA is guaranteed through ten years, making this a good point for a preliminary evaluation. The all SPIA solution will have paid out over $147,500 in nominal terms, while the hedged combo has paid only $118,000. But, there remains almost $75,000 nominal in the TIPS hedge. If the annuitants were to die at ten years and a day, the combo leaves them better off by $45,000.

The next step is crucial. SPIA payments continue for life—but only for life. That is the key weakness or shortfall of the SPIA when evaluated over a long interval. Payments can stop in a heartbeat—or rather, as soon as the heartbeat stops.

Hence, after the guarantee expires, it is appropriate to apply survival weighting to the annuity amounts. The weighting applies to the $14,756 of the all-SPIA solution, and to the $10,000 SPIA component of the hedged combination. It does not apply to the TIPS payments, which are fixed over the interval and not contingent on continued life.

The survival probabilities are shown in red. Yellow highlights show the survival-weighted value of the all-SPIA payments. Blue cells show the survival weighted value of the $10,000 SPIA payments plus the TIPS top off for that year.

Note how by year 13, the all-SPIA annual payments fall below those of the combo. When the hedge ends at age 100, the sum of payments from the combo remains ahead of the all-SPIA solution.

Next, survival weighting continues out to age 119. Only the survival-weighted SPIA component of the combo continues. The all-SPIA payments catch up a little but not by much. Odds of survival to such an advanced age are simply too tiny to budge the needle.

Score 2 for the hedged combination.

Fine print

Survival weighting applied this way reflect the expectation at the level of a randomly chosen member of the annuitant pool. One could instead hold off on survival weighting until after life expectancy (=the expectation for the pool collectively). The combo advantage would then shrink to about $33,000.

Conclusion

1.Even moderate inflation of 3% severely erodes the value of a stream of fixed payments over a multi-decade period, thus motivating the search for a hedge.

2.The hedged combination pairs the annuity, which is no longer an investment, with TIPS, which are an investment. Appreciation on the investment, inflation plus the real return, is part of what gives the hedge its power.

Next steps

I have a variety of stress tests in mind but welcome suggestions. Upcoming posts will look at:

1.Inflation risk;

2.Interest rate risk;

3.Age-related variation in results.

And at some point I will adapt Table 2 to explore the Hedge As You Go strategy.

Should you hedge your TIPS ladder with an SPIA?

Arguably, the TIPS ladder is the more foundational product, and the life annuity is the more derived and secondary.

-TIPS are guaranteed by the full faith and credit of the US Treasury. Full stop. An SPIA is guaranteed by some financial intermediary whose financial statements, even though available for inspection, are probably beyond the capability of most annuitants to evaluate.

-A TIPS ladder guarantees a level stream of real income over a preset interval. An SPIA guarantees only a stream of fiat currency, and only for some unknown interval which could be quite short (=life).

Be that as it may, the two products do seem to have offsetting strengths and weaknesses, making it possible that some hedged combination of the two might be superior to either alone.

-The SPIA insures against excess life

-The TIPS ladder insures against excess inflation.

This thread examines various possible combinations.

“Hedge once and done” versus “Hedge as you go”

Hedge once and done means to take out the SPIA and set up the TIPS ladder at the same time in mutually calibrated amounts. It is the primary hedge examined in this thread.

Hedge as you go entails annuitizing a larger sum than needed for spending, and investing the excess income in TIPS each year, until inflation catches up and there is no longer an excess, after which point, the TIPS accumulation begins to be drawn down to sustain real spending power. It will be set out in a later post.

Any hedge has to be compared to BOTH of the two pure, unhedged alternatives:

1.All the funds placed in an unhedged SPIA

2.All the funds put into a TIPS ladder, no SPIA

The purpose of the thread is to explore such comparisons.

Let me acknowledge once, at the outset, that there are many, many ways to skin the annuity cat (see, for instance, StillGoing’s thread on deferred annuities viewtopic.php?t=433101). This thread confines itself to one approach.

Illustrative case

For the initial evaluation, a single illustrative case is held constant.

•Clients are a married couple in their early 70s (say, 74) with a joint life expectancy of 20 years.

•The crediting rate on the SPIA is about 5%, with a 10-year term certain guarantee

•Inflation is assumed to be 3%

•The real rate on TIPS is the difference, at 2%

•Given the assumed crediting rate and life expectancy, an SPIA in the amount of $125,000 will produce a fixed income stream of about $10,000 per year, guaranteed for the first ten years.

The next decision is how far out to hedge, i.e., to what age. Mortality tables, by current convention, have non-zero entries out to age 119. Going out to that age would imply a very expensive hedge that would almost certainly be in excess of what is needed.

Conversely, about half of any pool of 74-year-old couples will outlive their life expectancy of age 94, implying the need at least to hedge past that age.

For these illustrations I hedge out to age 100. About 11% of the pool will survive to 101 or older; these fortunate individuals will see the hedge come off and real income fall. However, the nominal payment will continue for life, which is part of the appeal of a hedged combination.

Couples of this age, convinced that one will prove to be a centenarian, can hedge past age 100, out to age 104, using the longest TIPS available in the US. There is only a 2.6% chance that that hedge will fall short (=survival to 105 and beyond). Preliminary tests showed no difference in the pattern of results for hedging 30 years instead of hedging to age 100, so no further discussion will be made.

Here’s how the setup looks in table form.

Table 1

*If inflation were constant and every TIPS maturity yielded exactly 2.0% then the divisor should be 1.02 * 1.03 = 1.0506. Uncertainty on this score suggests using the sum instead.

The cost of the hedge is about $59,000, or 47% more than the $125,000 annuitized. Total amount available to put into either of the two pure alternatives is thus $183,890.

Tests of the hedge

The pure TIPS ladder alternative can be tested by means of the PMT function, entering the real return of 2%, the period of 26 years, and the total funds available. As shown at the bottom of the table, the pure ladder could only sustain real payments of $9,139 per year, decisively less than the $10,000 real sustained by the hedged combination.

I should note that $9,139 is not bad within a sustainable withdrawal rate frame; it corresponds to a withdrawal rate of almost 5% (albeit, not strictly comparable to the 4% rule, which assumed a 30-year span).

Score 1 for the hedge.

The pure SPIA alternative is a little more difficult to test. A second table will be of assistance.

Table 2

table continues:

If we annuitize all the available funds, the annual payment increases, no surprise, by about 47%, to $14,756. That is considerably more, in year 1, than the $10,300 paid under the combo.

Look next at the results after ten years. The SPIA is guaranteed through ten years, making this a good point for a preliminary evaluation. The all SPIA solution will have paid out over $147,500 in nominal terms, while the hedged combo has paid only $118,000. But, there remains almost $75,000 nominal in the TIPS hedge. If the annuitants were to die at ten years and a day, the combo leaves them better off by $45,000.

The next step is crucial. SPIA payments continue for life—but only for life. That is the key weakness or shortfall of the SPIA when evaluated over a long interval. Payments can stop in a heartbeat—or rather, as soon as the heartbeat stops.

Hence, after the guarantee expires, it is appropriate to apply survival weighting to the annuity amounts. The weighting applies to the $14,756 of the all-SPIA solution, and to the $10,000 SPIA component of the hedged combination. It does not apply to the TIPS payments, which are fixed over the interval and not contingent on continued life.

The survival probabilities are shown in red. Yellow highlights show the survival-weighted value of the all-SPIA payments. Blue cells show the survival weighted value of the $10,000 SPIA payments plus the TIPS top off for that year.

Note how by year 13, the all-SPIA annual payments fall below those of the combo. When the hedge ends at age 100, the sum of payments from the combo remains ahead of the all-SPIA solution.

Next, survival weighting continues out to age 119. Only the survival-weighted SPIA component of the combo continues. The all-SPIA payments catch up a little but not by much. Odds of survival to such an advanced age are simply too tiny to budge the needle.

Score 2 for the hedged combination.

Fine print

Survival weighting applied this way reflect the expectation at the level of a randomly chosen member of the annuitant pool. One could instead hold off on survival weighting until after life expectancy (=the expectation for the pool collectively). The combo advantage would then shrink to about $33,000.

Conclusion

1.Even moderate inflation of 3% severely erodes the value of a stream of fixed payments over a multi-decade period, thus motivating the search for a hedge.

2.The hedged combination pairs the annuity, which is no longer an investment, with TIPS, which are an investment. Appreciation on the investment, inflation plus the real return, is part of what gives the hedge its power.

Next steps

I have a variety of stress tests in mind but welcome suggestions. Upcoming posts will look at:

1.Inflation risk;

2.Interest rate risk;

3.Age-related variation in results.

And at some point I will adapt Table 2 to explore the Hedge As You Go strategy.

Statistics: Posted by McQ — Fri Jun 07, 2024 4:56 pm — Replies 1 — Views 148