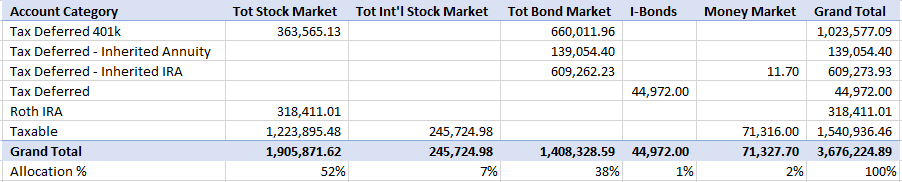

Planning to retire soon. Below is my portfolio as of a few months ago. It's now grown to around 3.8M. I'm 63 and I'll take SS at 70 and estimate I'll receive around 45k/year. No pension or additional income. For living expenses I need around 100k/year pretax. Planning to 100 though I suppose it's unlikely I'll live that long since both my parents died at 85-86.

Based on the modeling I've done with Firecalc and the Fidelity retirement planning tool, my portfolio could withstand a 50% equity crash. However I still worry there will be a crash just as I retire. So my thought is to move $200k out of Total Bond Fund in the Inherited IRA and into something short term like treasuries or CDs. If I run this change through the retirement modeling tools, it doesn't seem to have much impact on the success of my plan. So maybe I should just do it to my reduce anxiety. I saw in some other post where Klangfool said he keeps 2-3 years expenses available in cash. I don't have an easy way to do this right now in my taxable account without creating a capital gains tax liability since I'm still working and in a high income bracket. I'd appreciate anyone's thoughts.

![Image]()

Based on the modeling I've done with Firecalc and the Fidelity retirement planning tool, my portfolio could withstand a 50% equity crash. However I still worry there will be a crash just as I retire. So my thought is to move $200k out of Total Bond Fund in the Inherited IRA and into something short term like treasuries or CDs. If I run this change through the retirement modeling tools, it doesn't seem to have much impact on the success of my plan. So maybe I should just do it to my reduce anxiety. I saw in some other post where Klangfool said he keeps 2-3 years expenses available in cash. I don't have an easy way to do this right now in my taxable account without creating a capital gains tax liability since I'm still working and in a high income bracket. I'd appreciate anyone's thoughts.

Statistics: Posted by catchinup — Tue Aug 13, 2024 1:20 am — Replies 12 — Views 895