Due to a series of events, my husband is working to get a better handle on his parents' finances and help them make adjustments where needed. He does have financial POA but hasn't used it before now. They are in their early-mid 70s, still competent, but not particularly knowledgeable. We have a lot to do yet, including getting a clear picture of their income and expenses. However, we do know they are not well off - i.e., if they need LTC at some point they will quickly become dependent on Medicaid, and inheritance is not a consideration.

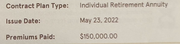

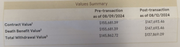

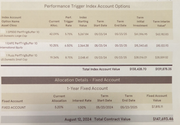

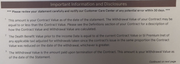

Their sole investment/retirement account seems to be an individual retirement annuity with Jackson National Life with just under $150k. As best we can determine, this account (or its predecessor contracts) would have been set up about 25 years ago (by their BIL, no longer involved), when my FIL was laid off from his long time employer - we think the source was probably some sort of pension conversion/payout but we don't know any details (this was a company that would have had a pension way back in the day). Below are some snips from the one document my FIL had handy (a transaction record from a withdrawal).

![Image]()

![Image]()

![Image]()

![Image]()

![Image]()

![Image]()

I've done enough reading to know this is probably not be best option for them, due to fees if nothing else, but am not close to understanding what to do about it. Obviously we don't want to make a costly mistake with regard to surrender fees, tax implications, etc. Given their age and financial situation, if we were to invest these funds, we'd likely be looking at a VERY conservative AA - capital preservation is a much higher priority than growth.

My husband will be contacting the agent on Monday to learn more, so my first and most immediate questions are:

- what documents should he ask for?

- what questions should he ask? (or not ask!)

Then, to the extent anyone can tell from the limited info available:

- What type(s) of annuity might this be? (i.e., what do I google to learn more?)

- How does this thing even work??

- Is this likely a tax-advantaged account of some sort? In what way?

- Is it possible this is a qualified annuity, such that we could roll it into an IRA? How would we tell?

- If it isn't, and we'd have to surrender it into a taxable account, does that even make sense?

Thank you!

Their sole investment/retirement account seems to be an individual retirement annuity with Jackson National Life with just under $150k. As best we can determine, this account (or its predecessor contracts) would have been set up about 25 years ago (by their BIL, no longer involved), when my FIL was laid off from his long time employer - we think the source was probably some sort of pension conversion/payout but we don't know any details (this was a company that would have had a pension way back in the day). Below are some snips from the one document my FIL had handy (a transaction record from a withdrawal).

I've done enough reading to know this is probably not be best option for them, due to fees if nothing else, but am not close to understanding what to do about it. Obviously we don't want to make a costly mistake with regard to surrender fees, tax implications, etc. Given their age and financial situation, if we were to invest these funds, we'd likely be looking at a VERY conservative AA - capital preservation is a much higher priority than growth.

My husband will be contacting the agent on Monday to learn more, so my first and most immediate questions are:

- what documents should he ask for?

- what questions should he ask? (or not ask!)

Then, to the extent anyone can tell from the limited info available:

- What type(s) of annuity might this be? (i.e., what do I google to learn more?)

- How does this thing even work??

- Is this likely a tax-advantaged account of some sort? In what way?

- Is it possible this is a qualified annuity, such that we could roll it into an IRA? How would we tell?

- If it isn't, and we'd have to surrender it into a taxable account, does that even make sense?

Thank you!

Statistics: Posted by smwisc — Sun Aug 18, 2024 7:18 am — Replies 1 — Views 155